Call for a Consultation!

440-349-3670

Hours: Monday - Thursday:

8:30AM to 5:00PM.

Friday: 8:30AM to 4:30PM.

Blog - Author: Jay Toole

Author: Jay Toole

5 Reasons We Love Christmas in Cleveland

While we dream of a white Christmas, we won't let the lack of snow stop us from enjoying all the exciting things happening around Cleveland. As a gem of the midwest, here are our top 5 things we love to do around the city. #1 WinterFest lights in Public Square Thousands of glowing bulbs light up every inch of downtown's Public Square. Fun to run through, walk through with your little kids, or even do a casual drive through. #2 Visit Bill Hixon for an Ornament Famous to many life-long locals, few outsiders know the history of Hixon's in Lakewood. Bill Hixon is known for his custom Christmas ornaments with many featuring scenes of the season or landmarks around northeast Ohio. He even designs beautiful ornaments that are on display at the White House! If you are lucky, you can even get this 92 year old legend to sign your bulb. #3 "You'll shoot your eye out." at the Christmas Story House Nestled away in Cleveland is the world famous Christmas Story House from the loveable tale of Ralphie, Red Ryder BB Guns, and the pink bunny suit. Give this a visit or sign up for the road race that will finish right at the house next December! #4 Christmas Ale. Christmas Ale Everywhere! Cleveland is known for its world-class beers. From Great Lakes Christmas Ale to Thirsty Dogs 12 Dogs Christmas Ale to the newest arrival of Masthead Brewing Co's Robot Santa's Christmas Ale, if you are a beer connoisseur or just a lover of all things delicios then y

Total Loss Doesn't Have To Be A Total Bummer

Tips on Insuring Your Home How much coverage do you really need? One word: Replacement Cost. If it is your personal residence, your home should be insured to the amount it would cost to replace the home and not what it may sell for on the market. Insurers and homeowners share a common goal, of reducing exposure to losses (from fires to theft to catastrophic storms) and ensuring that consumers have adequate homeowners coverage in place to recover from financial losses that can occur. As your insurance agent, we continually strive to use the most accurate tools in helping homeowners make the right coverage decisions. 1.Make sure you update you limits overtime The issue of underinsurance (insurance to value) usually arises following a major catastrophe that destroys many homes in a particular area. In the aftermath of a catastrophe, the cost of rebuilding can skyrocket and consumers who have not recently reviewed and updated their insurance policies sometimes find that they do not have enough coverage to rebuild. This is why insurers encourage homeowners to conduct a yearly review of their insurance needs. - Did you remodel your home? - Did you add an addition? Although it is impossible to precisely predict the exact cost of rebuilding a home at some future date, it is important to insure the home for an amount that takes into account rising building costs. Once the replacement costs are estimated, the insurer can help the homeowner determine how much cov

When it Rains, It Pours - Personal Umbrella Policies

We get it - insurance is can be as confusing as reading a recipe your grandma wrote in 1960. You hear terms like limits, deductibles, premiums, exemptions, and more and it just feels like the dollar signs are piling up. However, at Graydon-Toole Group, we take a customer first approach. We represent over a dozen insurance carriers, but our loyalty lies with one person; you. So, when we review your needs and see you could greatly benefit from the protection from a Commercial or Personal Umbrella Policy, there is a reason {or three} why we recommend it. When it rains, it pours. And like the physical umbrella we all hold near and dear during a Summer storm, an Umbrella Policy is there to protect you when costs from a claim keep piling on. Reason #1 Added Protection: Personal Umbrellas are there to protect you where your homeowners or auto policy limits fall short. Should a claim cost more than the limits of your current policy, Reason #2 It’s cheap! A Personal Umbrella Policy for $1 million in extra coverage can be as little as $200 for an entire year. Reason #3 You don’t have to be a millionaire to have a $1 million personal umbrella policy. You don’t need to own a home, be married, have kids or be a certain age to have one. If you drive a car, cross a street or has people over to your home (either rented or owned), you may need this coverage. Even if someone is trespassing on your property, you could be liable for any injuries. This is just a quic

Carry on my wayward son, we'll keep you covered while you're at it.

Time flies and before you know it, you not-so-little-ones fly the coup and head off to college. While an exciting chapter of their life begins, with it comes a few new challenges to overcome. Do you have a young adult heading off to college? College can be a fun time for the student but a stressful one for the parent. Reduce some of the stress by planning ahead to make sure your college student has appropriate insurance protection while away at school. Insurance companies cover full-time students under age 25 in various ways. You’ll want to consult your agent at Graydon Toole Group with questions about your specific policy and situation. The 3 Basic Ways Your Student May Have Coverage: 1. As a percentage of the personal property limit on the parents’ homeowner policy. Many insurance companies consider campus housing a secondary residence for the student and may cover your student’s possessions as a percentage of the personal property limit on your homeowner policy – personal property means items you can remove from your home or premises. For example, if you have $75,000 in personal property coverage, your student may have 10 percent of that, or up to $7,500, in coverage for belongings taken to school. Liability coverage – which insures legal liability for bodily injury or property damage to others – may not be included. 2. As part of the personal property limit included in the parents’ homeowner policy. Some insurance comp

All about community - Our donation nominee was awarded $5,000!

Community support has been one of the pillars of organization since our founding over 80 years ago. It started with the orginal Graydons being a part of the Chambers of Commerce and other outreach programs. Our clients and business partners have always been our neighbors and we take great pride this great state of O-H-I-O. We were honored when Westfield Insurance, one of the insurance carriers we represent, selected our nomination, the North Royalton Family YMCA, to be the receipient of a $5,000 grant. The YMCA holds the same values as us when it comes to providing a positive impact on the community and it was a pleasure to present them with a check. To commemorate the occasion, owners Tim Graydon, Pete Graydon, and Kevin Toole visited the Y to present the check and say a few words. Tim Graydon said the following: Westfield Insurance has endowed a private foundation that reflects Westfield’s desire to support communities and impact those areas that align with their objectives. Westfield is devoted to nonprofit partners who help families push through troubled times, guiding them to a better place and a better future. The North Royalton YMCA is doing this through youth fitness, family activities. It is our hope and belief that Westfield’s generous donation will be used to these ends to help families in our area and in so doing strengthening our community. Family and family values are at the core of Graydon – Toole Insurance Group. Our staff has

What if you have a water back up in your basement?

Snapshot: Document everything that was removed from the basement in a detailed list. Remove carpet or other damaged flooring. Assess if further remediation is needed from a restoration company and contact your insurance agent. April showers may bring May flowers, but they could also bring some serious headaches. Common in old homes and homes built at low points relative to storm drains can suffer from basement flooding and water back up when a storm is heavy enough. This can mean water flooding the basement from drains or even sewage from the toilet. In the former case, the water may not have human waste but still be dirty enough to ruin your carpet, drywall, wood stairs, and household items that can absorb liquid. We have dealt with this personally and would gladly impart our wisdom onto you. Be prepared prior to the upcoming storms Keep electronics, shoes, towels, stuffed animals, and other items that can absorb water on higher shelves or in sealed, plastic totes. Totes without lids can be effective but if the water rises high enough then it can (and in our case did) flip the bins. In frequent flooding cases, a storm well or safety drain can be dug into a basement that will mitigate the risk of water flooding your home. Many local companies can provide this service- or shoot us an email for a reference. Document everything! One more time for good measure. Document EVERYTHING. Create a detailed list of all the items that were ruined due to the flooding. This i

Not All Auto Policies are Created Equal - 3 Things to Ask Your Agent

Your softball buddies ask you out for a burger after the season opener. You think to yourself, “I ran around the bases at least 3 times. I’ve earned it”. You jump in the co-pilot seat of your teammate’s car and motor on to the downtown strip. In the distance you see the familiar sign of your favorite pub and can just taste the flamed burger that awaits. And just as you think your celebration is ready to commence, your classless teammate turns into the drive-thru at the nationwide burger joint that we will call PacDonalds. You feel crushed and a bit queasy. That second feeling may be from the food that has yet to hit your stomach. This fast food lesson can apply to almost any aspect of your life but as insurance nerds, we thought it gave a good representation how not all insurance policies are created equal. Check out these 3 questions you should be asking your agent about your auto policy. What are my limits? You hear the term ‘state minimum’ often from a certain gecko, caveman, or general on tv commercials. This term refers to minimum dollar amount of coverage you must have to legally drive. In Ohio the required minimum for Bodily Injury Liability Coverage is currently $25,000 per person injured in any one accident and $50,000 for all persons injured in any one accident. The required minimum for Property Damage Liability Coverage is $25,000 for injury to or destruction of property of others in any one accident (commonly displayed as 2

Getting to Know GTG: Josh Dykstra the Boat Guy

Towering over everyone in the office at 6 foot 5 inches, Josh is our go-to guy for files on the top shelf or if you need a really high, high-five. Being our marina and boat insurance specialist, you can usually find him on Lake Erie with his wife and son, catching as much Cleveland sunshine as possible before Winter sets in. Recently, Josh’s passion for our Great Lake moved him to starting a non-profit dedicated to protecting and preserving this resource. The aptly named Eriesponsible has a mission to take steps now to preserve the health of Lake Erie for future generations. They take a common sense and economically viable approach that anyone can be a part of. From simple trash pick up as we boat or enjoy a beach front park to being more careful and using proper procedures when refueling your boat, Eriesponsible is dedicated to leading the charge. They will be offering educational programs, selling ecofriendly boating equipment, and doing their part to protect the lake for generations to come. Do you own a boat, marina, or dock along Lake Erie? Reach out to Josh at Josh@Eriesponsible.org or Josh.D@InsureOhio.com with all your questions on keeping our Lake clean, marine and boat insurance, or to be a part of the next beach clean

The Dollar Bill Tip and How Your Credit Card Company Could Help You While on the Road

When Tim Graydon decided to catch some sun rays during this cold, Cleveland winter, he and his wife headed down to Florida for a week to get away. Most of the bookings for the trip were done using his credit card that had some helpful perks including reimbursement for damage to rental cars if said card was used for the payment. This will be important later. During a leisurely lunch stop, Tim pulled his rental car into a spot next to a well-kept BMW and went in to enjoy a bite to eat. Upon leaving, the unfamiliar turn radius of the rental led to rubbing against the BMW leaving a 4-inch scratch across the door. After kicking himself for a silly mistake, Tim snapped a photo of the scratch next to a dollar bill and alerted the driver of the car. Dollar Bill Tip: Using a piece of US currency is greatly encouraged by insurance companies as it gives adjusters a uniform reference when looking at claims in photos. Being a nice car, this scratch ran a hefty bill of $700. We will cover the pros and cons of submitting a claim for an invoice this size in a future post but Tim’s auto coverage had a deductible of $250. This means that Tim’s insurance would cover the remainder of the bill after Tim paid the full deductible of $250. This is all standard stuff until you factor in the credit card company’s reimbursement perk. After submitting the proper paperwork to the credit card company, they agreed to pay the deductible due to Tim using the card for the

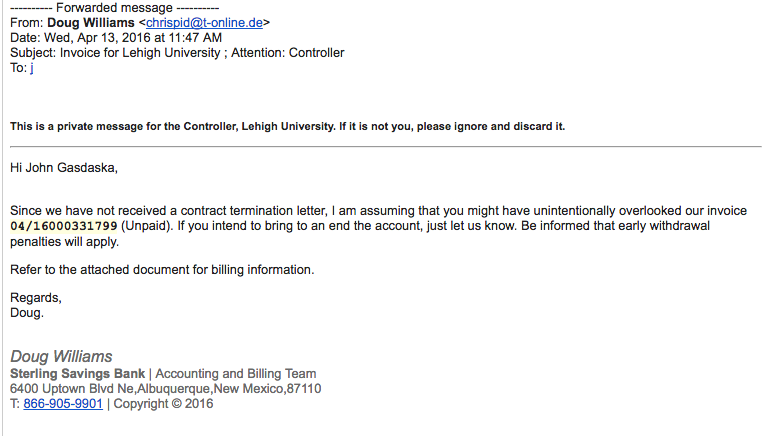

How to spot Spoofing and Email Phishing

Spotting Email Spoofing and Email Phishing is easy when you know what to look for. Read the definitions and examples below and protect yourself from these cybercriminals. Email Spoofing According to TechTarget.com: Email spoofing is the forgery of an email header so that the message appears to have originated from someone or somewhere other than the actual source. Email spoofing is a tactic used in phishing and spam campaigns because people are more likely to open an email when they think it has been sent by a legitimate source. The goal of email spoofing is to get recipients to open, and possibly even respond to, a solicitation. Although most spoofed email falls into the nuisance category and requires little action other than deletion, the more malicious varieties can cause serious problems and pose security risks. For example, a spoofed email may purport to be from a well-known shopping website, asking the recipient to provide sensitive data such as a password or credit card number. Or the spoofed email may ask the recipient to click on a link that installs malware on the recipient's computing device. Email Phishing Phishing is a type of online scam where criminals send an email that appears to be from a legitimate company and ask you to provide sensitive information. This is usually done by including a link that will appear to take you to the company’s website to fill in your information – but the website is a clever fake and the information y

View Cart []

View Cart []